22

Nov

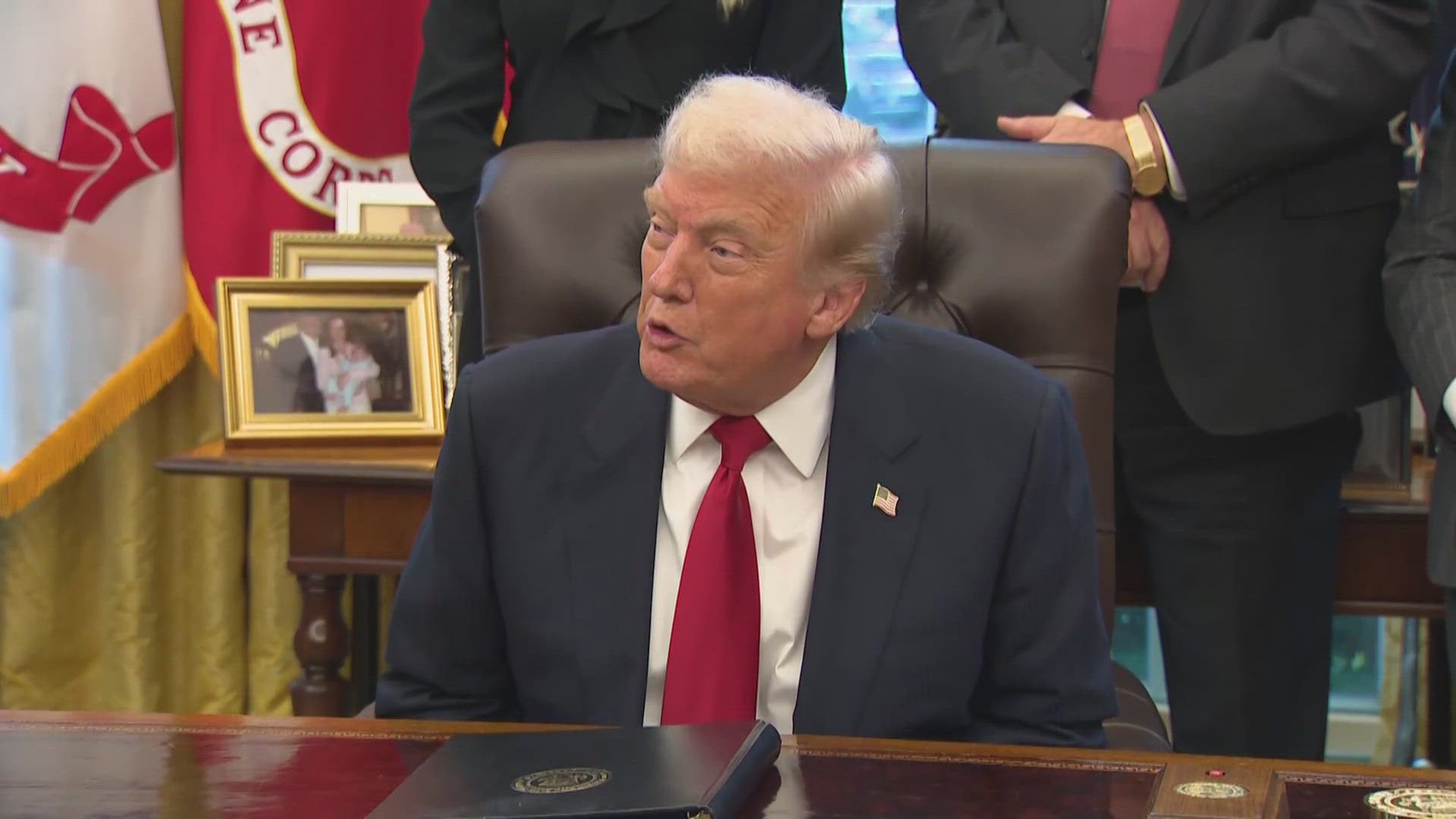

For most of 2025, the White House touted cheaper gas as proof of economic success—but recent trends show prices are now virtually the same as a year ago, complicating that narrative.President Donald Trump and his economic advisors frequently pointed to reduced gasoline costs as proof of enhanced economic accessibility during his tenure. Throughout a significant portion of 2025, this assertion seemed valid, given that fuel prices were distinctly lower compared to the corresponding period under former President Joe Biden. Nevertheless, current statistics indicate that this disparity has largely disappeared, casting doubt on a prominent economic claim made by Trump. As…